Page 18 - Book6E

P. 18

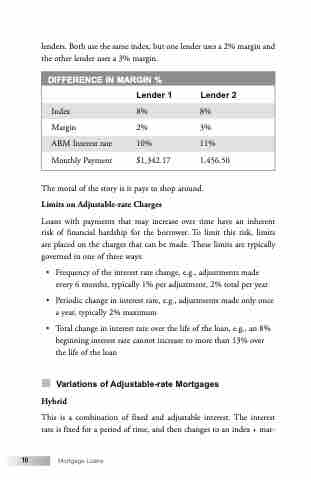

lenders. Both use the same index, but one lender uses a 2% margin and the other lender uses a 3% margin.

DIFFERENCE IN MARGIN %

Lender 1 Lender 2

Index 8% 8%

Margin 2% 3%

ARM Interest rate 10% 11%

Monthly Payment $1,342.17 1,456.50

10

Mortgage Loans

The moral of the story is it pays to shop around.

Limits on Adjustable-rate Charges

Loans with payments that may increase over time have an inherent risk of financial hardship for the borrower. To limit this risk, limits are placed on the charges that can be made. These limits are typically governed in one of three ways:

• Frequency of the interest rate change, e.g., adjustments made every 6 months, typically 1% per adjustment, 2% total per year

• Periodic change in interest rate, e.g., adjustments made only once a year, typically 2% maximum

• Total change in interest rate over the life of the loan, e.g., an 8% beginning interest rate cannot increase to more than 13% over the life of the loan

Variations of Adjustable-rate Mortgages

Hybrid

This is a combination of fixed and adjustable interest. The interest rate is fixed for a period of time, and then changes to an index + mar-