Page 48 - Book2E

P. 48

40

________________

________________

Let’s Review_______________________________________

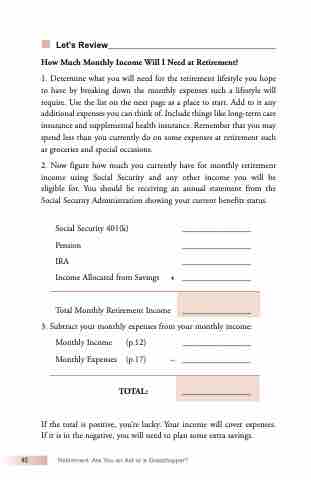

How Much Monthly Income Will I Need at Retirement?

1. Determine what you will need for the retirement lifestyle you hope to have by breaking down the monthly expenses such a lifestyle will require. Use the list on the next page as a place to start. Add to it any additional expenses you can think of. Include things like long-term care insurance and supplemental health insurance. Remember that you may spend less than you currently do on some expenses at retirement such as groceries and special occasions.

2. Now figure how much you currently have for monthly retirement income using Social Security and any other income you will be eligible for. You should be receiving an annual statement from the Social Security Administration showing your current benefits status.

Social Security 401(k)

Pension

IRA

Income Allocated from Savings

+

________________

________________

________________

________________

Total Monthly Retirement Income

3. Subtract your monthly expenses from your monthly income:

Monthly Income (p.12) ________________ Monthly Expenses (p.17) – ________________

TOTAL:

If the total is positive, you’re lucky. Your income will cover expenses. If it is in the negative, you will need to plan some extra savings.

Retirement: Are You an Ant or a Grasshopper?