Page 44 - Book2E

P. 44

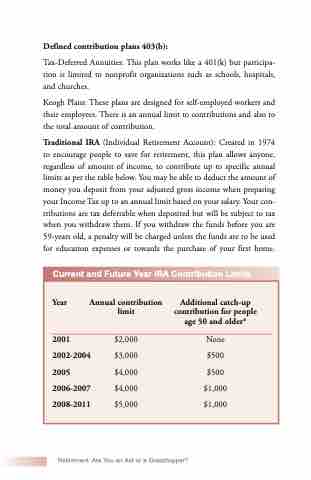

Current and Future Year IRA Contribution Limits

Year Annual contribution limit

Additional catch-up contribution for people age 50 and older*

None $500 $500 $1,000 $1,000

2001 2002-2004 2005 2006-2007 2008-2011

$2,000 $3,000 $4,000 $4,000 $5,000

Defined contribution plans 403(b):

Tax-Deferred Annuities: This plan works like a 401(k) but participa- tion is limited to nonprofit organizations such as schools, hospitals, and churches.

Keogh Plans: These plans are designed for self-employed workers and their employees. There is an annual limit to contributions and also to the total amount of contribution.

Traditional IRA (Individual Retirement Account): Created in 1974 to encourage people to save for retirement, this plan allows anyone, regardless of amount of income, to contribute up to specific annual limits as per the table below. You may be able to deduct the amount of money you deposit from your adjusted gross income when preparing your Income Tax up to an annual limit based on your salary. Your con- tributions are tax deferrable when deposited but will be subject to tax when you withdraw them. If you withdraw the funds before you are 59-years old, a penalty will be charged unless the funds are to be used for education expenses or towards the purchase of your first home.

Retirement: Are You an Ant or a Grasshopper?