Page 81 - Book10E

P. 81

CHAPTER 10

Individual Retirement Accounts (IRA)

Traditional IRA

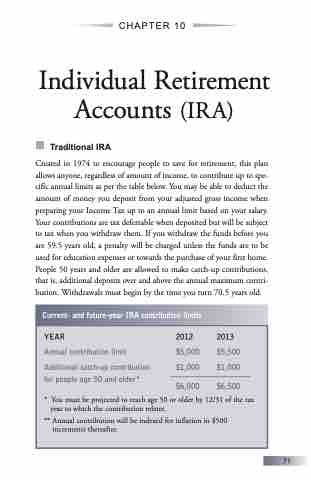

Created in 1974 to encourage people to save for retirement, this plan allows anyone, regardless of amount of income, to contribute up to spe- cific annual limits as per the table below. You may be able to deduct the amount of money you deposit from your adjusted gross income when preparing your Income Tax up to an annual limit based on your salary. Your contributions are tax deferrable when deposited but will be subject to tax when you withdraw them. If you withdraw the funds before you are 59.5 years old, a penalty will be charged unless the funds are to be used for education expenses or towards the purchase of your first home. People 50 years and older are allowed to make catch-up contributions, that is, additional deposits over and above the annual maximum contri- bution. Withdrawals must begin by the time you turn 70.5 years old.

Current- and future-year IRA contribution limits

YEAR

Annual contribution limit

Additional catch-up contribution for people age 50 and older*

2012 2013

$5,000 $5,500 $1,000 $1,000

$6,000 $6,500

* You must be projected to reach age 50 or older by 12/31 of the tax year to which the contribution relates.

** Annual contribution will be indexed for inflation in $500 increments thereafter.

71