Page 28 - Workbook1E

P. 28

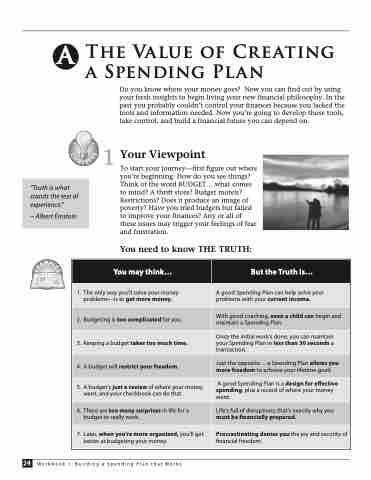

A The Value of Creating a Spending Plan

Do you know where your money goes? Now you can find out by using your fresh insights to begin living your new financial philosophy. In the past you probably couldn’t control your finances because you lacked the tools and information needed. Now you’re going to develop those tools, take control, and build a financial future you can depend on.

1 Your Viewpoint

To start your journey—first figure out where you’re beginning. How do you see things? Think of the word BUDGET... what comes to mind? A thrift store? Budget motels? Restrictions? Does it produce an image of poverty? Have you tried budgets but failed to improve your finances? Any or all of these issues may trigger your feelings of fear and frustration.

You need to know THE TRUTH:

“Truth is what stands the test of experience.”

~ Albert Einstein

You may think...

But the Truth is...

1. The only way you’ll solve your money problems—is to get more money.

A good Spending Plan can help solve your problems with your current income.

2. Budgeting is too complicated for you.

With good coaching, even a child can begin and maintain a Spending Plan.

3. Keeping a budget takes too much time.

Once the initial work’s done, you can maintain your Spending Plan in less than 30 seconds a transaction.

4. A budget will restrict your freedom.

Just the opposite... a Spending Plan allows you more freedom to achieve your lifetime goals

5. A budget’s just a review of where your money went, and your checkbook can do that.

A good Spending Plan is a design for effective spending, plus a record of where your money went.

6. There are too many surprises in life for a budget to really work.

Life’s full of disruptions; that’s exactly why you

must be financially prepared.

7. Later, when you’re more organized, you’ll get better at budgeting your money.

Procrastinating denies you the joy and security of financial freedom.

24 Workbook 1: Building a Spending Plan that Works