Page 21 - Workbook1E

P. 21

Are you paying interest or earning it?

The more money you invest each month in savings—the more your money works for you. The more you save for a longer time, the greater your savings grows, the faster and farther you’ll go toward financial health. See what happens when you save or invest.

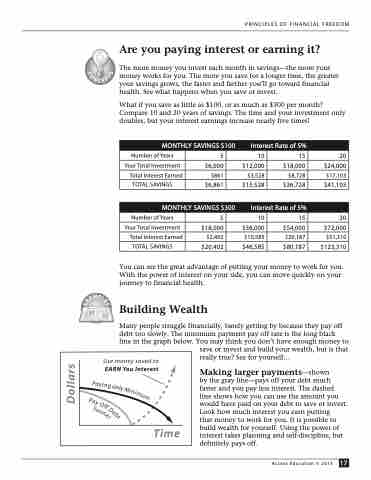

What if you save as little as $100, or as much as $300 per month? Compare 10 and 20 years of savings. The time and your investment only doubles, but your interest earnings increase nearly five times!

PRINCIPLES OF FINANCIAL FREEDOM

MONTHLY SAVINGS $100

Interest Rate of 5%

Number of Years Your Total Investment

Total Interest Earned TOTAL SAVINGS

5 $6,000 $861 $6,861

10 $12,000 $3,528 $15,528

15 $18,000 $8,728 $26,728

20 $24,000 $17,103 $41,103

20 $72,000 $51,310 $123,310

MONTHLY SAVINGS $300

Interest Rate of 5%

Number of Years Your Total Investment

Total Interest Earned TOTAL SAVINGS

5 $18,000 $2,402 $20,402

10 $36,000 $10,585 $46,585

15 $54,000 $26,187 $80,187

You can see the great advantage of putting your money to work for you. With the power of interest on your side, you can move quickly on your journey to financial health.

Building Wealth

Many people struggle financially, barely getting by because they pay off debt too slowly. The minimum payment pay off rate is the long black line in the graph below. You may think you don’t have enough money to

save or invest and build your wealth, but is that really true? See for yourself...

Making larger payments—shown

by the gray line—pays off your debt much faster and you pay less interest. The dashed line shows how you can use the amount you would have paid on your debt to save or invest. Look how much interest you earn putting

that money to work for you. It is possible to build wealth for yourself. Using the power of interest takes planning and self-discipline, but definitely pays off.

Access Education © 2013 17